Contributions and Investments

What contributions are payable?

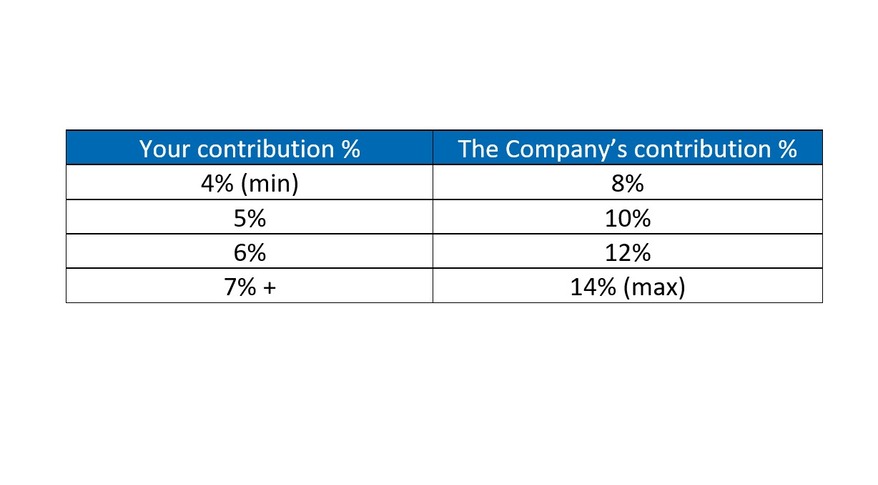

On joining you will be enrolled at the minimum employee contribution rate of 4% of your basic gross salary. Imperial will pay contributions at the rate of 8% of your gross basic salary. Following your first month of membership you can increase your contribution. There is a range of regular contribution levels as shown in the table. Whichever of the four rates you select to pay, the Company will pay double your chosen rate up to a maximum of 14% of your pensionable pay.

How do I increase my contributions?

You can elect to increase your pension contributions in your Workday record. Navigate to the ‘Benefits’ section of your Workday record and select the ‘Pension’ option and from the drop down menu select your chosen contribution rate. You will receive further instructions on how to do this as part of your induction welcome pack. Please contact Imperial's People & Culture Operations Team if you encounter any difficulties in making the change.

How do I pay one off lump sum contributions?

If the lump sum contribution you wish to pay falls within your gross monthly pay and national minimum wage requirements are met, the contribution can be paid via payroll, and you should complete a one-off lump sum application form which can be found via the link below. If the lump sum contribution you wish to pay is too large to be paid via payroll it is possible to pay it direct to Legal and General and you should contact the L&G helpline about this.

What if I am a former DB employee member and I want to start paying AVCs?

If you want to start paying or increase your contributions you will need to complete an AVC election form.

What are the benefits of making pension savings to Imperial's scheme?

The Fund operates member contributions on a 'Salary Exchange' (sometimes referred to as a 'Salary Sacrifice') basis. Salary Exchange brings savings to both members and the Company by reducing the amount of National Insurance (NI) contributions paid by both parties. This contribution method immediately also gives you full tax relief at the point of contribution. So, for example, if you are a 40% tax payer you will immediately benefit from tax relief at the rate of 40%.

If you pay a one off lump sum contribution directly to Legal and General you will need to claim the tax relief due on the contribution back from HMRC.

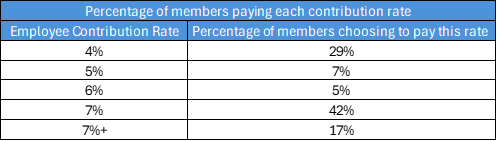

Percentage of members paying each contribution rate

Figures correct as at 31 March 2024

Investments

On joining the Fund your contributions will be automatically invested in the default investment fund, the L&G Target Date Fund, unless you choose otherwise. Please click below to find out more about the different investment strategies and investment funds available with L&G.