Retirement options

For members of the DC Fund

When you retire the value of your Retirement Account will be used to buy benefits. The level of your benefits will depend on three things:

- The amount of contributions paid into your Retirement Account

- The investment returns those contributions have earned

- The cost of buying benefits at retirement

There are three main options when deciding how to use your Retirement Account when drawing benefits:

- Income drawdown

- Annuity purchase

- Cash

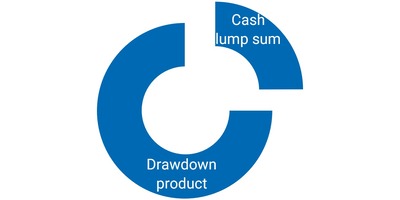

Income drawdown

Income drawdown is a specialist area and the Fund does not offer a drawdown facility. If you wish to take advantage of the drawdown option you will need to transfer your Retirement Account ( after electing whether to draw any of it as a cash lump sum) to an external product. Income drawdown is a way of receiving pension income when you retire while allowing your pension pot to keep on growing. An income drawdown policy allows you to draw out regular sums from your pension pot whilst leaving the balance of your pot invested. If your investments do well, your pension pot can carry on growing which means your retirement income will increase too. But remember, the value of your income could also go down if your investments do badly.

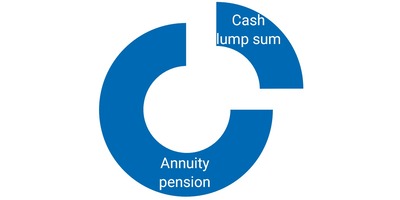

Annuity

If you decide to purchase an annuity (a pension) with part of all your Retirement Account then you would need to purchase this with a provider of your choosing.

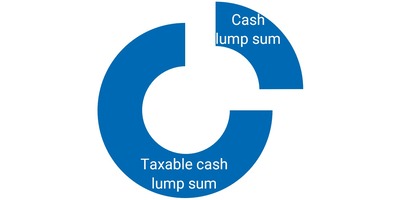

Cash

You may take all of your Retirement Account as cash but only 25% of the value of your Retirement Account can be paid tax-free, the remaining 75% would be subject to income tax.

Legal and General will provide you with details of your options prior to you drawing benefits.

The Trustee recommends that you obtain independent financial advice when considering your options on retirement.